Banking for the

digital age

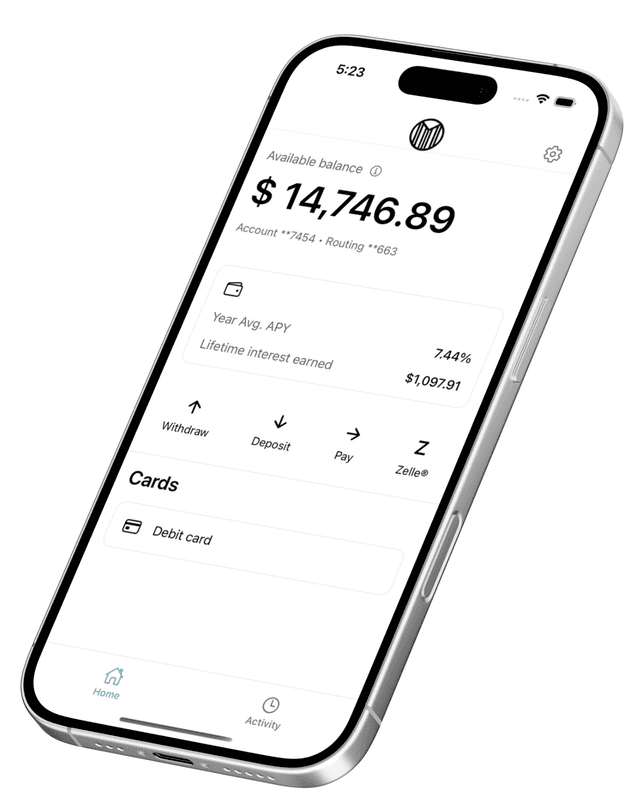

A modern banking platform, powered by the digital dollar.

Send, receive, and earn 7% interest on U.S. dollars globally.

How Does It Work?

Traditional Banking

You deposit into your bank

The bank lends out YOUR dollars and charges interest to the borrower

While the bank is earning, they give you almost nothing

How Momentum Works

You deposit into Momentum

Momentum facilitates the loan with your dollars

Momentum shares the entire lending yield with you

It is your money at the end of the day

Get global access to U.S. dollars

Momentum makes it easy for you to access banking services anywhere in the world.

Accept and send USD globally

Transfer USD quickly with ACH, Fedwire, SWIFT, and SEPA so you can move money globally with ease.

Earn up to 7% rewards

Earn either 4-5% APY backed by U.S. Treasuries or 7% APY via Momentum lending.

Spend with Visa card globally

Use your Momentum card anywhere in the world with no foreign transaction fees.

Use stablecoins for 24/7 transfers

Send money instantly anywhere in the world, any time of day, with zero transfer fees using stablecoins.

Accept and send USD globally

Transfer USD quickly with ACH, Fedwire, SWIFT, and SEPA so you can move money globally with ease.

Earn up to 7% rewards

Earn either 4-5% APY backed by U.S. Treasuries or 7% APY via Momentum lending.

Spend with Visa card globally

Use your Momentum card anywhere in the world with no foreign transaction fees.

Use stablecoins for 24/7 transfers

Send money instantly anywhere in the world, any time of day, with zero transfer fees using stablecoins.

Frequently asked questions

Can I replace my traditional bank with Momentum?

↑Yes. With Momentum, you can seamlessly send and receive US dollars just like a traditional bank account. However, behind the scenes, your transactions are smarter and safer. Every dollar you deposit is automatically converted into stablecoins, which are then backed by US treasuries in our secure digital environment.